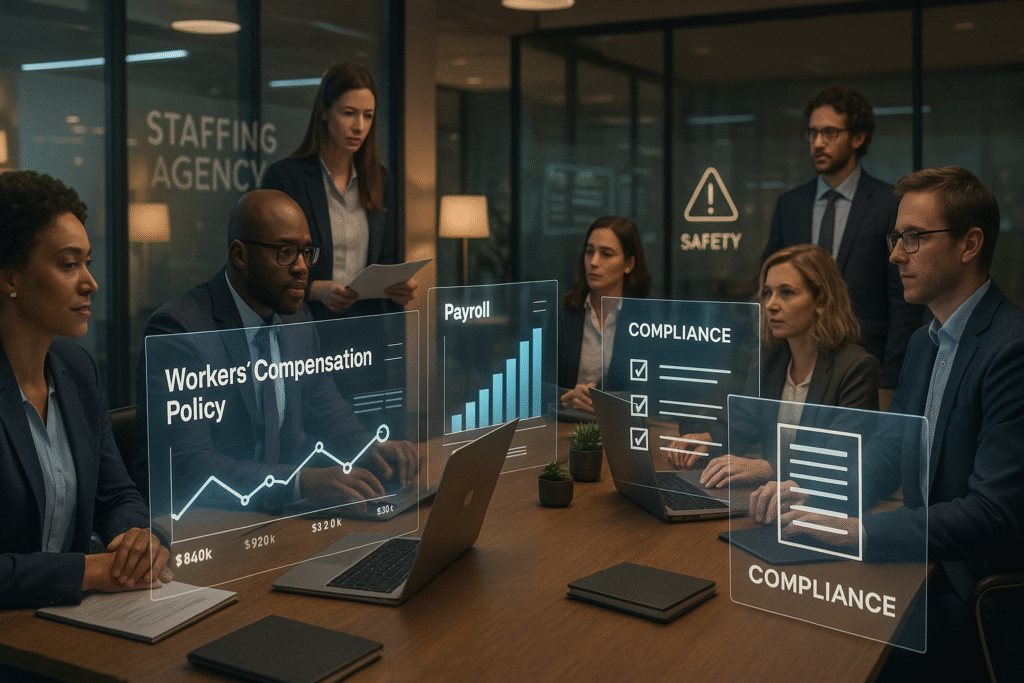

Staffing agencies face unique workplace risks daily. They place employees across multiple industries and job sites. Each placement creates new safety, liability, and compliance challenges. Workers compensation insurance protects agencies from costly injury claims.

Choosing the right policy ensures financial stability and legal compliance. The best workers comp insurance for staffing agencies reduces risk exposure. It also supports employees who are injured during recovery.

Why Staffing Agencies Need Specialized Workers Comp Coverage

Staffing agencies operate differently from traditional employers. They manage temporary, contract, and seasonal workers. These workers often perform high-risk duties. Examples include construction, warehousing, and manufacturing roles. Standard policies rarely address these complexities. Specialized coverage accounts for varying job classifications. It also adapts to fluctuating payroll and workforce size.

Staffing agencies share employer responsibilities with client companies. This relationship is called co-employment. Agencies handle payroll, taxes, and insurance administration. Clients control daily job tasks and workplace conditions. Workers comp policies must reflect this shared responsibility clearly.

What Is Workers Compensation Insurance

Workers compensation insurance covers job-related injuries and illnesses. It pays medical expenses for injured employees. It replaces a portion of lost wages. It also provides disability benefits when needed. Coverage protects employers from most employee lawsuits. States require workers comp coverage for most employers.

Key Risks Faced by Staffing Agencies

Staffing agencies face higher claim frequency. Temporary workers often lack site-specific safety training. Frequent job changes increase accident risks. Manual labor roles carry higher injury probabilities. Administrative errors can cause costly compliance penalties. The right policy addresses these risks effectively.

Slips, trips, and falls remain common injuries. Lifting injuries affect warehouse and logistics workers. Repetitive motion causes long-term musculoskeletal disorders. Machinery accidents impact manufacturing placements. Office placements also face ergonomic injury risks.

Features of the Best Workers Comp Insurance for Staffing Agencies

The best workers comp insurance for staffing agencies offers flexibility. It adapts to workforce changes quickly. It supports multiple job classifications accurately. It simplifies audits and reporting processes. Strong claims management reduces downtime and costs.

Accurate Job Classification Management

Correct job classification determines premium accuracy. Misclassification leads to audits and penalties. Specialized insurers understand staffing job codes. They adjust classifications as assignments change.

Pay-As-You-Go Premium Options

Pay-as-you-go billing matches premiums to actual payroll. This model improves cash flow predictability. Agencies avoid large upfront deposits. Premiums adjust automatically with payroll changes.

Why Coastalworkcomp Stands Out

Coastalworkcomp focuses on staffing industry risks. They understand co-employment complexities thoroughly. Their solutions prioritize compliance and cost control. They partner with carriers experienced in staffing exposures. Their approach reduces claim frequency over time.

Industry-Specific Expertise

Coastalworkcomp works with Staffing Agencies nationwide. They understand regulatory differences across states. Their expertise ensures accurate coverage placement. They tailor policies to agency growth strategies.

Risk Management Support

Proactive risk management lowers claim costs. Coastalworkcomp provides safety guidance and resources. They encourage injury prevention programs. These efforts improve employee safety outcomes.

Understanding Workers Comp Costs for Staffing Agencies

Workers comp costs depend on several factors. Job classifications heavily influence premium rates. Payroll size affects total policy cost. Claims history impacts experience modification rates. Safety programs can reduce long-term expenses.

The experience modification factor compares claim history. Lower modifiers reduce premium costs significantly. Higher modifiers increase insurance expenses. Effective claims management improves modifiers over time.

Compliance Requirements for Staffing Agencies

Each state enforces workers compensation laws. Staffing agencies must meet local requirements. Noncompliance leads to fines and legal action. Proper coverage ensures uninterrupted business operations. Coastalworkcomp helps agencies stay compliant.

Many agencies operate across multiple states. Each state has unique workers comp rules. Policies must address jurisdictional differences accurately. Specialized brokers manage these complexities efficiently.

Claims Management and Its Importance

Claims management affects long-term insurance costs. Delayed reporting increases claim severity. Effective communication speeds recovery outcomes. Strong claims handling protects employer interests. The best workers comp insurance for staffing agencies includes expert claims support.

Return-to-work programs reduce claim durations. They help injured employees resume suitable duties. These programs lower wage replacement costs. They also improve employee morale and retention.

Benefits of Long-Term Workers Comp Strategies

Long-term strategies reduce insurance volatility. Consistent safety practices lower injury rates. Stable premiums support predictable budgeting. Employees feel protected and valued. Clients trust compliant staffing partners.

Modern technology simplifies workers comp administration. Digital reporting improves claim accuracy. Online dashboards enhance transparency. Automated payroll integration reduces errors. Efficient systems save administrative time.

Why the Right Coverage Protects Agency Reputation

Workplace injuries affect public perception. Poor claims handling damages client trust. Strong coverage demonstrates professionalism. It reassures clients and employees alike. Reputation protection supports long-term success.

Growing agencies face increasing insurance complexity. New job categories require updated coverage. Expanding states demand compliance adjustments. Proactive planning prevents coverage gaps. Coastalworkcomp supports scalable insurance solutions.

Conclusion

Staffing agencies need specialized insurance solutions. Generic policies fail to address staffing risks. The best workers comp insurance for staffing agencies offers flexibility and expertise. Coastalworkcomp delivers industry-focused coverage strategies. Their approach supports compliance, safety, and growth. Choosing the right partner protects people and profits.

Frequently Asked Questions

What is the best workers comp insurance for staffing agencies?

The best workers comp insurance for staffing agencies offers flexible coverage. It supports multiple job classifications and changing payrolls. It also provides strong claims management and compliance support.

Is workers compensation insurance mandatory for staffing agencies?

Most states require staffing agencies to carry workers compensation insurance. Requirements vary by state and workforce size. Operating without coverage can lead to severe penalties.

How are workers comp premiums calculated for staffing agencies?

Premiums depend on job classifications and payroll amounts. Claims history also affects total costs. Higher-risk placements usually result in higher premiums.

Can staffing agencies use pay-as-you-go workers comp plans?

Yes, many insurers offer pay-as-you-go workers comp plans. This option aligns premiums with actual payroll. It improves cash flow and reduces upfront deposits.

Who is responsible for workers comp claims in staffing arrangements?

Staffing agencies typically handle workers comp coverage. Client companies manage daily supervision and workplace safety. Clear contracts define responsibilities in co-employment situations.