Small businesses in Montgomery face growing HR demands today. Many owners now struggle with payroll, compliance, recruiting, and risk management. These challenges increase pressure and reduce productivity. PEO Montgomery Alabama by Coastalworkcomp offers a reliable solution for these issues. The service helps businesses manage HR tasks with accuracy and efficiency. This guide explains how it supports business growth.

Understanding the Role of a PEO

A Professional Employer Organisation helps companies outsource complex HR duties. It supports payroll, benefits, workers’ compensation, and compliance management. Many businesses rely on a PEO to reduce administrative burdens. PEO Montgomery Alabama by Coastalworkcomp provides these services with consistent quality.

Why Businesses Choose a PEO

Businesses choose a PEO to gain stability and support. It improves workforce management efficiency. It reduces compliance mistakes. It also offers better benefit options. A PEO supports growth through reliable HR systems.

How a PEO Works for Employers

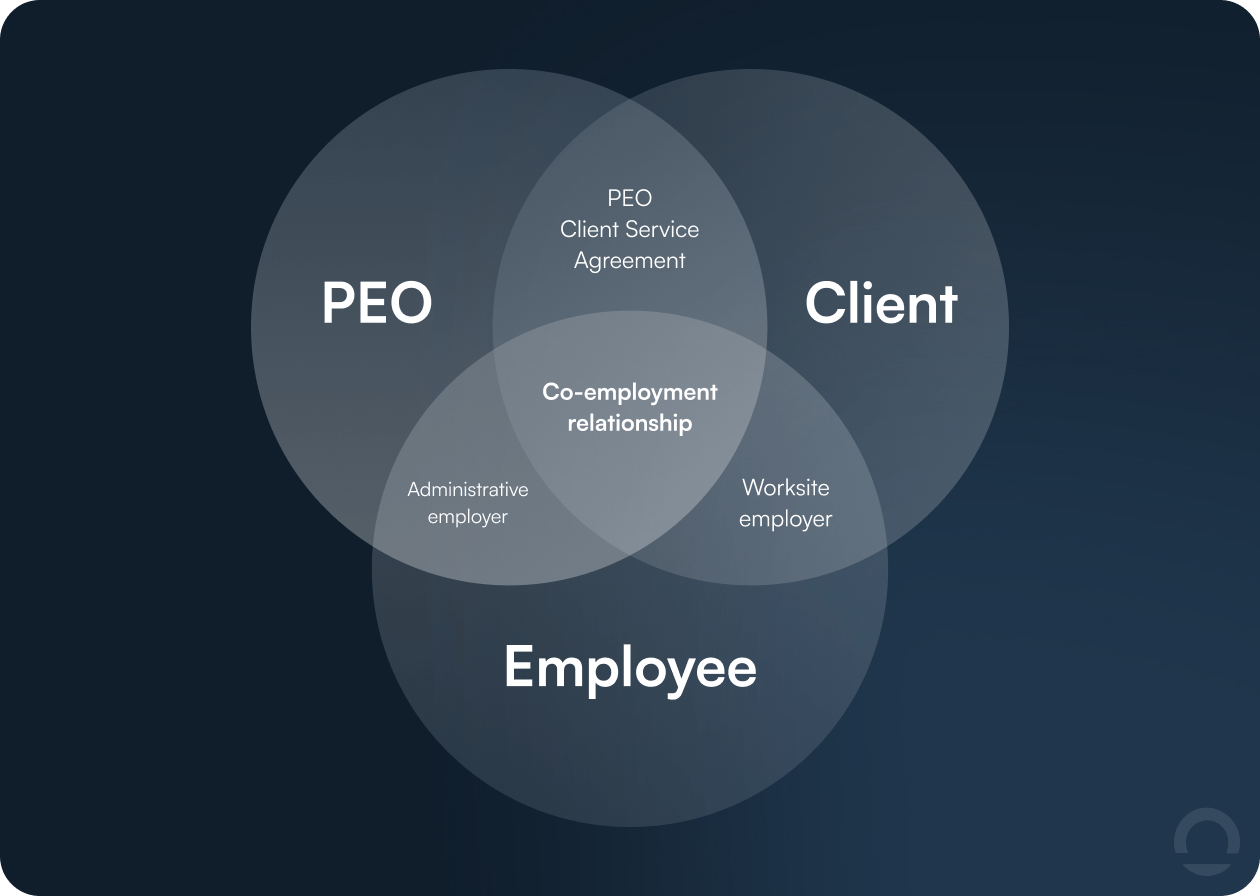

The PEO enters a co-employment agreement. This agreement allows shared employer responsibilities. The client keeps full control of daily operations. The PEO manages HR duties on behalf of the business. This approach gives companies freedom to focus on operations.

Benefits of PEO Montgomery Alabam

PEO Montgomery Alabama by Coastalworkcomp offers many benefits to local businesses. It simplifies HR tasks. It improves employee management. It strengthens compliance efforts. These benefits create a stable business environment.

Streamlined Payroll Services

Payroll processing requires accuracy and time. Errors cause financial risk. The service handles payroll with precision. It manages wage calculations. It manages tax filings. It issues payments on schedule. This support reduces financial stress.

Improved Compliance Support

Employment laws change often. Many small businesses cannot track every change. The PEO monitors legal updates. It guides businesses through compliance risks. It prevents penalties. It helps keep HR processes aligned with Alabama regulations.

Better Employee Benefits

Employees value strong benefits. A PEO provides access to competitive benefit plans. It offers health insurance options. It offers retirement plans. It offers wellness resources. These benefits improve retention and help attract skilled talent.

Why Montgomery Businesses Need a PEO Today

Montgomery holds a diverse business landscape. Industries in the area include healthcare, logistics, construction, and retail. Each industry faces unique HR challenges. A PEO supports every business type with consistent HR solutions.

Growing HR Complexity

HR rules grow more complex each year. Small business owners now face tight deadlines and many regulations. A PEO provides expert guidance. It prevents costly errors. It helps owners stay compliant without losing focus.

Rising Employment Costs

Employee management costs continue to rise. Benefits, payroll systems, and administrative tasks now require more investment. A PEO lowers these expenses. It offers shared resources. It uses combined buying power to provide affordable solutions.

How Coastalworkcomp Supports Business Growth

A PEO provides more than HR support. It builds a foundation for long-term growth. PEO Montgomery Alabama by Coastalworkcomp offers strategic advantages that help companies expand.

Enhanced Productivity

Employees become more productive with organized HR systems. A PEO removes administrative pressure. It allows leaders to focus on core goals.

Improved Stability

Businesses gain stable operations with accurate HR management. The PEO tracks regulations. It prevents compliance risks. It strengthens internal structure.

Better Hiring Quality

Strong benefits attract better talent. The PEO provides those benefits. It supports strong recruitment strategies. This improves workforce quality.

Lower Administrative Costs

Shared resources help reduce expenses. Businesses avoid large HR system investments. The PEO offers affordable service packages.

Choosing PEO Montgomery Alabama

Montgomery business owners value reliability and guidance. Coastalworkcomp delivers that support. It offers clear communication. It offers expert advice. It provides consistent results.

Local Expertise

The team understands Alabama regulations. It supports local industries. It helps businesses align with state requirements.

Dedicated Support

Clients receive personal assistance from trained professionals. This support builds trust. It improves HR outcomes.

Flexible Service Options

Coastalworkcomp offers flexible plans. Each plan fits different business needs. This flexibility helps companies control costs.

Concusion

PEO Montgomery Alabama by Coastalworkcomp helps businesses manage HR with efficiency. It offers payroll support. It handles compliance tasks. It improves employee benefits. It reduces risks. This service helps companies build strong teams and achieve growth. Montgomery businesses now rely on trusted HR partnerships. Coastalworkcomp delivers the right support for long-term success.

Frequently Asked Questions

What is a Professional Employer Organisation (PEO)?

A Professional Employer Organisation (PEO) is a company that manages HR tasks like payroll, employee benefits, and compliance. It allows businesses to outsource HR operations efficiently while focusing on growth.

How does a PEO partnership benefit my business in Chicago?

A PEO partnership helps your Chicago business reduce HR costs, stay compliant with Illinois labor laws, and access better employee benefits. It enhances efficiency and reduces administrative workload.

Why should I choose Coastalworkcomp as my PEO in Illinois?

Coastalworkcomp offers customized HR solutions, transparent pricing, and expert compliance support. Their experience across multiple industries makes them a reliable partner for Illinois businesses of all sizes.

Does Coastalworkcomp handle workers’ compensation insurance?

Yes. Coastalworkcomp provides complete workers’ compensation coverage and claims management. They ensure your business meets all state insurance requirements while keeping employees protected.

Can small businesses benefit from using a PEO service?

Absolutely. Small businesses gain access to affordable benefits, professional HR management, and compliance expertise through Coastalworkcomp’s Professional Employer Organisation Chicago, Illinois services.